by Prof Rajeev Srinivasan and Dr Abhishek Puri

A version of this essay was published by firstpost.com at https://www.firstpost.com/opinion/shadow-warrior-is-apples-spatial-computing-headset-vision-pro-a-brilliant-innovation-12879962.html

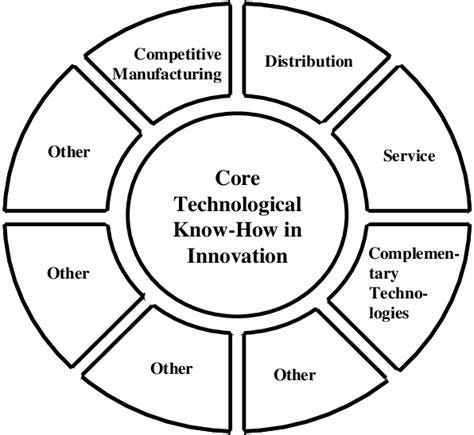

The introduction of the new Apple immersive computing headset, the Vision Pro, could well be a classic case study in future. It illustrates several memes: how to invent new products, how a fast-follower can often trump a pioneer, how complementary assets make the difference, how distribution channel clout can turn an invention into a successful innovation, and how new markets can be dominated if you have the ecosystem in place and, in particular, can set standards.

There is also a big caveat: Apple is asking users to change behavior, and they will not do so unless there’s a huge payoff.

It is true that Apple has been the most valuable company in the world by market capitalization for some time; it has a sterling reputation for beautifully designed products and for innovation; its users are fanatically attached to its products. But one of us asked a while ago whether Apple has peaked (https://swarajyamag.com/technology/has-apple-peaked) based on the fact that no disruptive innovation had come out of 1 Infinite Loop, Cupertino since the iPhone, which was in… 2007!

But that question, it now appears, may have to be revisited in view of the Vision Pro. Sure, the talking heads have dismissed it as a solution in search of a problem, because, let’s face it, the Metaverse has not really taken off despite the billions Meta (nee Facebook) has thrown at it. That was the new New Thing last year, but this year, it’s generative AI. Maybe next year it will be… spatial computing?

But what’s the use of this invention?

The real question is the use case for the product. Apart from the usual answers about surgery, machine repair, video games, and pornography, there doesn’t seem to be any crying need that the product addresses. It really does feel like an invention that’s being thrown out there, to see what sticks. There have been enough failures already: Google’s Glass and even the low-cost Cardboard (many of us have them in closets somewhere) were panned by the public.

Same with Meta’s Oculus. There is also some confusion between Virtual Reality and Augmented Reality, which is why Apple wisely chose to brand its product as ‘spatial computing’.

However, there are countless examples of how ‘lead users’ may make a product useful, even extraordinarily useful, in ways that the original inventor never anticipated. One is the motorcycle. It is said that the inventor thought it would be the perfect vehicle for the village postman in Germany, which of course vastly underestimated the number of use cases. Perhaps some of Apple’s customers will discover startlingly different users for the product.

Pioneer or fast-follower? Who wins?

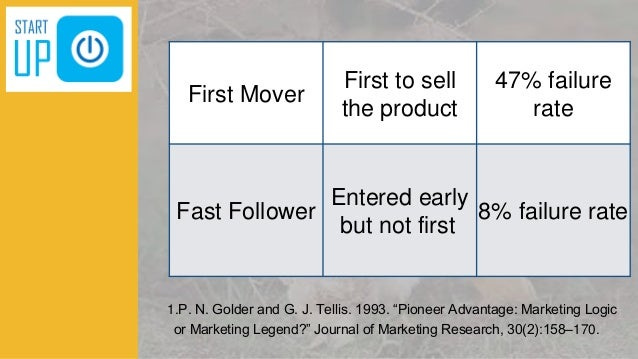

A standard theme is that pioneers frequently stumble in exploiting the market they created. It is quite possible that the winner is the fast-follower who jumps on board when the general contours of the marketplace are already clear. In the case of spatial computing, the pioneer is quite likely Meta, but fast-follower Apple may well be the winner.

If Apple seeds the market with the headset, people may find many uses for it. That would be one way to turn invention to innovation. An innovation is something that has actual traction in the marketplace, and turns into a success. Will Apple create a wave? We will have to wait and see. Even Apple is not infallible: it has failed in the past. Remember the Newton handheld device, which was such a failure that it caused Jobs to exit? But Apple has done the homework to try and make the Vision Pro a success.

No company is an island

The key is complementary assets, that is, things that others create that will make your product more attractive to the customer. A good example from the early days of the Apple Macintosh is the laser printer. The laser printer (from Canon) made the graphical user interface and WYSIWYG (what you see is what you get) of the Macintosh practical: remember that earlier printers were daisy-wheel or dot-matrix, incapable of printing graphics.

The complementary assets that matter the most are applications, or software written by third parties (the industry term is ISV: independent software vendors). If you capture the software developers, then the ‘spatial computing’ platform (virtual reality to the rest of us) will actually become useful, and people will buy the devices. Apple already has a loyal base of software developers: the App Store (30% commission to Apple) is a valuable asset. The current $3500 Vision Pro headset is targeted not towards consumers (too expensive) but towards ISVs, to whom Apple will likely give away the hardware.

We have already seen how ISVs have led the various stages of the computing industry: the minicomputer (pioneered by DEC), the engineering workstation (pioneered by Sun Microsystems), the PC (controlled by Microsoft and Intel), and the smartphone were/are all defined by the abundance of the software catalogs. For instance, when Sun Micro lost its dominance in mindshare with the ISVs to the PC, its hardware business quickly evaporated, and the company was sold off. Similarly, who even remembers DEC, once a stalwart?

The key to success is to create a platform that others can profit from. In a recent essay (The New Knowledge War, Open Magazine, 9 June 2023) on AI, we suggest that the platform of choice in generative AI may well be Meta’s open-sourced LLaMA, as opposed to Microsoft/OpenAI’s and Google’s proprietary large-language models. Open-sourced Gnu/Linux has been a success in operating systems, as there is an army of enthusiasts who epitomize the ‘Cathedral and the Bazaar’ syndrome.

However, openness is not a necessary condition for success, especially in hardware. Apple is itself an example, and so are Microsoft/Intel. Both these models, proprietary hardware-software stacks controlled by the IPR owners, have been tremendous market successes. In the world of AI, Nvidia, which many think is an overnight success, has, on the contrary, a 30-year-history of creating a good hardware-software platform including its CUDA suite.

It is possible that Apple is attempting to emulate what Nvidia did in a new market: create a compelling platform that would attract the third-party software developers, which would, in turn, generate a momentum of its own.

Distribution channel is the elephant in the room

Then there is the channel. Technical people severely underestimate the value of being able to reach the end consumer. But a good example is Microsoft. Even though its fans will disagree, that company has consistently made average products, but the fact that they could reach billions of users through that excellent channel (the Windows operating system), sustained them for many years. They could push all sorts of things through the channel, and nobody else had quite that reach (until Apple and Google put together their app stores).

Max Weber, a sociologist, observed that the government is unique among social institutions in that it alone can use force to achieve its objectives. Classic market failures of externalities, public goods and information asymmetry contribute to market power. These externalities are avoided by the command of ‘enforcement’ (through taxes or antitrust laws) that have been justified to preserve the greater common good. Public choice has been described by James Buchanan (a Nobel Laureate) as “politics without romance”. In the best case scenario, this theory assumes that people make rational choices to capture much value for themselves; the mores of traditional economics assume that people are rational self-interest maximizers.

Creating new markets, say in film and entertainment?

The final piece of the puzzle comes in the ability to conquer entirely new markets. Apple has made progress towards this (for example consider its forays into financial services and co-branded credit card with Goldman Sachs). This is in addition to its profitable services such as Apple Pay, Apple Music and Apple TV+.

One clue as to what a new market might be comes from Apple TV. Bloomberg reported that Apple is spending $1 billion a year to promote film, which is an interesting choice considering it is a crowded field.

Philosophically speaking, one could say that Apple plays the long game. ‘Long termism’ anticipates the evolving landscape and sacrifices current profits for a long term sustainable flow of funds. A standard tactic to achieve this is to influence standard-setting and develop rent-seeking. Apple is doing all of the above.

In its flurry of announcements, Apple quietly slipped in the release of a relatively new specification: 360° video (sometimes called spherical video) is footage captured by special cameras that point lenses in all directions to create a panoramic sphere of video. Using special software, the different views are stitched together and typically stored in a rectangular frame called an equirectangular projection

Equirectangular projection squeezes the image much like the way a flat world map displays the entire surface of the round Earth. This specification, unsurprisingly, works with Final Cut Pro; another of Apple’s standards that works only on MacOS.

The genesis of Final Cut Pro has roots in Apple TV, which isn’t a successful platform. However, Apple was able to enforce its standards for streaming through Apple TV+ which needs Apple TV codecs to run, and this set the stage for selling more copies of Final Cut Pro, its video editing software.

Is Apple Vision Pro headed in the same direction? The product demo definitely highlighted the ability to use it for entertainment. Apple’s does have some history in Hollywood, with Disney.

Theaters are struggling in the US with the onslaught of streaming video. Despite the mushrooming of the streaming services and eye popping investments by many competitors to the tune of many billions of dollars, Apple Studios announced spending just $1 billion a year, which is pocket change for them. They are also dabbling in theatrical releases that would give them an edge in distribution.

Market-shaping?

By broad academic consensus, this represents a classical ‘market shaping strategy’; there’s something more than meets the eye. It is possibly an attempt to straddle market disruption and market widening.

To quote another example, the hit movie Avatar with its somewhat predictable storyline and relatively unknown actors was a showcase to demonstrate a new method of 3D film-making which had previously relied on expensive iMAX cameras; it also adapted 3D film making for existing screens. iMAX may offer an immersive experience through use of proprietary codecs but the recurring expense of making movies and screening them deters widespread adoption.

Apple long dabbled in movie-making through Pixar but sold it to Disney and took board seats to steer the direction of the industry by offering expensive workstation rigs to create movies via ‘standards’ essentially determined by Apple.

There are several reasons why Apple might now aspire to buy Disney. It would be a driver for services revenues. It offers a brand with a ready-made channel; plus, it can provide reams of content to Vision Pro and lock in customers. However, given the antitrust regulatory environment (hello, Lina Khan!), this admittedly is unlikely to happen. But let’s never say never.

Standards setting and rent seeking

Public choice theory also predicts the behavior of corporations with conflict of interests; firm managers operate on the same principle of self-interest maximization; they play on government officials’ self-interest. The term ‘rent-seeking’ is credited to Anne Krueger from 1974, and refers to efforts to capture above-normal returns by harnessing governments’ coercive powers and denying users a greater share of surplus.

This hobbles market competition. Rent-seeking therefore creates monopolies or oligopolies, in effect harming consumers. If you analyze Apple’s corporate behavior in terms of rent seeking, the underlying strategies become clear.

The German term Gesamtkunstwerk roughly translates as a ‘total work of art’ and describes an artwork, design, or creative process where different art forms are combined to create a single cohesive whole. It places the emphasis squarely on the integrated monolith that the final product represents. Apple encapsulates these ideas by design (in software, hardware and applications) utilizing its access to policy, regulation and market capitalisation to achieve its goals.

In contrast, Microsoft/Intel’s Wintel duopoly is more disintegrated, i.e. not quite as monolithic, in that it allows third parties to dominate certain niches; which of course means the user experience is not as coherent or uniform.

Can computers really see like humans?

Last but not least are hardware issues related to vision. Humans perceive vision individualistically and it is hard for technology to address it; Apple hasn’t released any scientific studies either. It is a well known fact that some low latency systems can process scan lines from camera to the display with near zero latency but they may not be fast enough for intensive applications like night vision.

Mixed reality headsets have raised a troubling issue: misalignment may cause unpleasant effects as the brain may adapt temporarily to an unnatural view and lag in readjusting to natural vision. There have been no reports about visual coordination and depth perception.

While not wading into the complex dynamics of human visual perception (‘saccades’ and subjective information or display illusions), it is virtually impossible for the computer system to know what is ‘seen by the humans’. In addition, peripheral vision (usually low resolution and sensitive to motion) is important to prevent accidents. These glasses are likely to block it.

The tradeoffs are significant, although definitely VIsion Pro is better than Meta/Oculus. If you extrapolate the economics, policy, standards and rent-seeking behavior, Vision Pro as a product category becomes apparent. It is therefore not surprising that Vision Pro announced its deferred release to spike the interest of the developers and users alike. The larger goal appears to be services revenue through entertainment by setting their own standards for movie-making.

Vision Pro may not be ground-breaking but it represents a significant improvement. Facebook’s Oculus has sold glasses for over three years now (running on Android and commoditised Qualcomm chips) without creating a useful product (games, healthcare or anything else).

Apple’s announcement of Vision Pro isn’t in the same league as the dramatic iPhone announcement, especially given the sticker-shock price of $3500. There’s a possibility that it will eventually be subsidized for retail use, though it has a similar vibe to the iconic 1984 release of the Macintosh, where Apple succeeded in changing user behavior with its ‘Big Brother’ and ‘the computer for the rest of us’ campaigns.

There are questions around product fit too; Apple’s implementation of AR is that you ‘look through it’. Apple believes in setting standards and

therefore, the current device sets the standards for a ‘minimum available specification’. None of the competing firms have Apple’s advantages: custom chips (M1 and R1 running “real-time-OS”, derived from iOS), supply chains for high density screens, and clout with regulators to push for policy changes.

Conclusion

Given Apple’s size, influence, technical capability, and sheer laser-like focus on the user experience, it is not hard to imagine that the Vision Pro can become its next industry-changing product. However, there are cautionary tales: the innovative Macintosh is only a niche player, the Newton PDA was a failure, the me-too iPod/iTunes was a hit, the iPad was a modest success, the novel iPhone was a smash hit. So we shall have to wait and see which of these Vision Pro will emulate.

2550 words, 4 Jul 2023

Share this post