A version of this essay was published by firstpost at https://www.firstpost.com/india/are-things-looking-up-for-india-at-makar-sankranti-a-time-for-new-beginnings-10286661.html

It is true that the usual suspects and the usual problems remain: malign forces including moles and sleeper cells inside the country; a stepped-up assault on India and Hindus from the Deep State and other ill-wishers; an almost-war on the Tibet border; the creaking bureaucracy and especially the judiciary; and the single-minded hostility towards the Government of India projected by US Big Media and Big Tech.

In the midst of all this, let us consider a few things that make it look like India is on the upswing, while sounding a few notes of caution.

Technology Trends

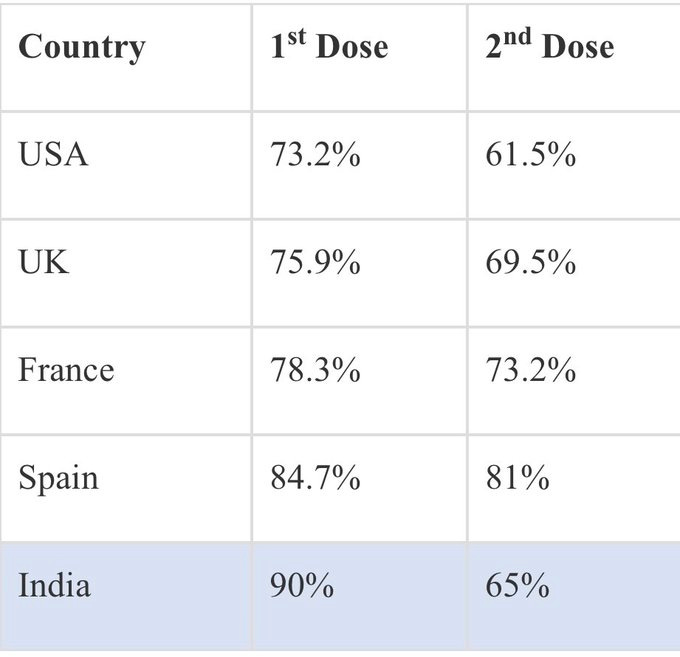

Just a short while ago, there were two big announcements: India hit 1.5 billion vaccinations; and India hit $100 billion in digital transactions in October and November. The first is an example of how, against the odds and in the face of determined opposition by vested interests, India has managed to vaccinate a significant number of its people who are eligible for them, almost entirely with Indian-manufactured or Indian-developed vaccines. It means the State has capacity to scale and that the private sector has the capacity to do process and product innovation.

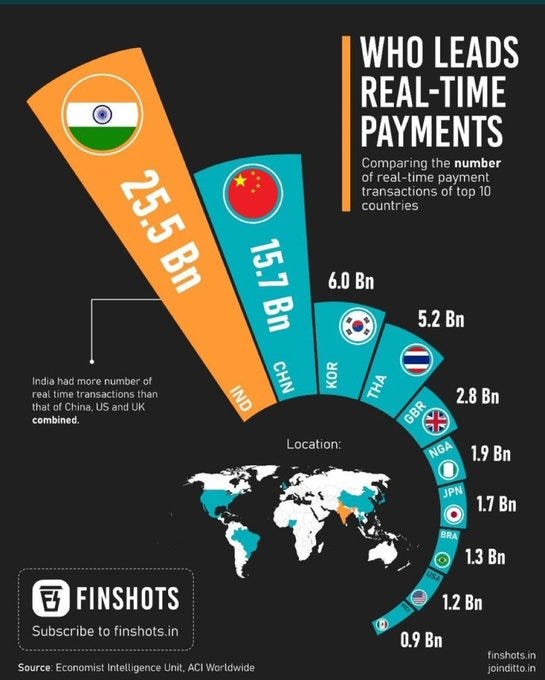

The second is an example of leapfrog: India now has more digital transactions than the next three or four countries combined, and this has happened where skeptics said there are no POS machines, no electricity, etc. The humble mobile phone has been a game-changer, and the public has taken to QR codes with gusto: they are ubiquitous. This is hopeful: it means India can use and improve on current tech models. Perhaps radical new technologies such as crypto currencies will take root in India.

India has been a technology laggard in the last century or two. But there is no inherent reason for that to continue. India’s STEM people are very competent: for instance, see how they dealt with technology denials such as with the cryogenic rocket engine or the Cray supercomputer. If we can harness upcoming technologies we should be able to ride the next innovation tsunamis. In areas such as web 3.0 with their distributed nature, Indians may well create the platforms of the future.

One example of the public acceptance of tech is the immense popularity of mobile phones. There are also the ingenious ways in which people have used them. For instance, there is the ‘missed call’ semaphore whereby you convey a specific message, such as “I have reached my destination”, without actually using up a call! A Harvard case study talks about how fishermen in Kerala increased their average profits by 12% by using their cell phones out at sea to talk to big buyers, cut out middlemen and take their catch to the optimal fishing port.

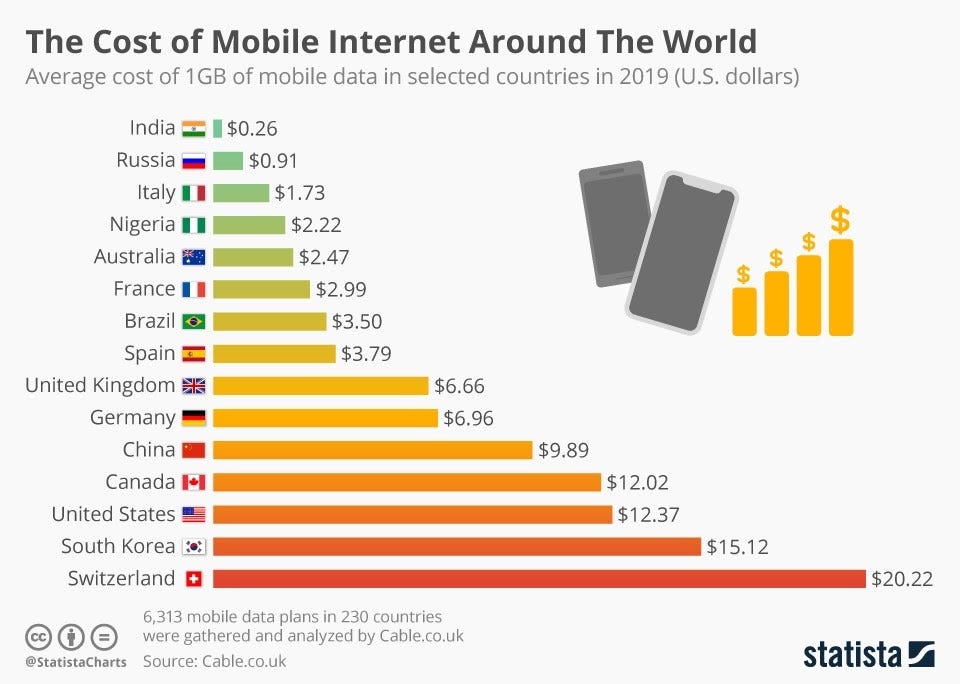

The uptake of mobile internet has been phenomenal, and is growing at a rate that will soon rival China. Once Reliance Jio brought inexpensive bandwidth to the masses, usage took off with entertainment and education (in a famous case, a railway porter studied for the State administrative services on his phone with free WiFi at the station, and got through the exam). There is an open-ness in India to science and technology, quite possibly because Dharmic religions are not anti-science or anti-logic.

One of the hopeful signs is the drive to set up a semiconductor fabrication facility in India. Since computers and cellphones and Internet of Things or IoT devices including connected cars will increasingly drive our future, it is imperative that we have the ability to manufacture the key component of all this, i.e. silicon chips. It is one of several seminal technologies we need to be present in: AI, blockchain, crypto currencies, quantum computing, CRISPR-Cas9 in biology. At the moment, we are far behind in all of them. This cannot continue, and we need to put in a crash program, like America’s Manhattan Project, to catch up.

Indian economy

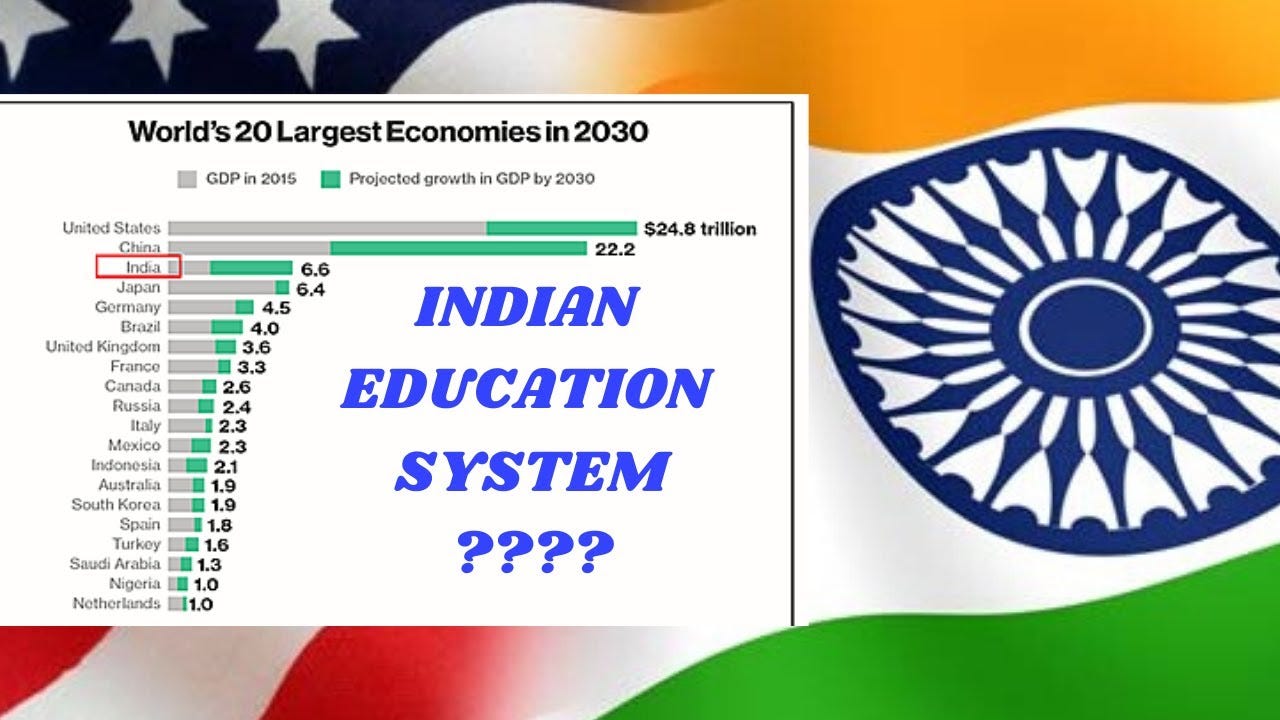

India is the fifth largest economy in the world, having overtaken Britain in the recent past (which of course is a matter for some schadenfreude). India should overtake Germany and Japan in the next ten years. So India is a player.

The GDP growth figures of 8 to 9% in 2021 need to be seen in the context of the huge contraction due to the wuhan virus last year, but the important fact is that it is believed that this level can continue for the next several years. Both the World Bank and the IMF have suggested India will once again be the fastest growing large economy in the world. I am more optimistic about the 2023-2024 outlook than this:

This is not coming on the back of massive increases in money supply, as in the US which appears to have printed money by the boatload, which is leading to inflation. Indian inflation, if you adjust for sky-high energy prices, is not all that bad. Incidentally, even with the prospect of higher interest rates in the US, the rupee is not falling: it hit a 3 month high of $1 = 73.9 Rupees on Jan 11th. This implies investors are pricing in India’s improved economic prospects. The reasons are quite basic: improved state finances and thus improved infrastructure investment, along with a young and growing working class which is beginning to be a consumption engine.

Geo-politics and geo-economics

Things look a little tough in the near future both from the point of view of global politics and global economics. The Cold War between the US and China, despite President Biden’s conciliation or appeasement depending on your perspective, will probably get worse, and I would not be surprised if there is an actual invasion of Taiwan. I wrote twenty years ago about that possibility, and now it looks increasingly likely that the US may not have the will, or the capability, to defend Taiwan in that case. The conflict between the US and China may well lead to the concept of a Thucydides Trap, where the two exhaust themselves. That makes for a dangerous world, and India may have to step into the breach for the defense of the Indo-Pacific.

From an economic perspective, the massive amounts of money printed by many countries, to combat the covid crisis, is likely to lead to inflation and thus the progressive weakening of the US dollar. The fallout from the Evergrande crisis shows that the extraordinary leveraging of China based on huge corporate and public-sector debt fueled by real estate speculation may also cause prolonged pain, just as it happened to 1980s Japan which has struggled for decades now.

The chances of war in Asia, especially in Taiwan, or in Japan’s Senkaku Islands, or even in the South China Sea, are fairly high. India is part of the Quad, of course, but we should not be under any delusions that the US, Japan or Australia will come to our aid if war erupts on the Tibetan border. We will be entirely on our own, so it behooves us to be prepared to fight. We have to choose our friends carefully, and at the moment I see only two in Asia: Japan and Vietnam. Maybe Indonesia, too. The others are more likely to choose China.

Education

Unfortunately India needs a veritable revolution in education, or else it will miss the boat. Unlike East Asia, which opted for universal primary education, India invested in tertiary education. This created a few oases of excellence in a sea of mediocrity, and this is yet another reason manufacturing hasn’t taken off at East Asian levels, and probably never will.

Also, just last week, the CAG was complaining that at least the new IITs were not producing enough research or industrial consultancy revenue, and were still depending on the government for handouts. That shows a disconnect between the needs of industry and what academia is doing.

There are also concerns about the much-vaunted STEM schools, which are now producing skewed numbers. For instance, in Kerala, 5500+ students opted for computer science, but less than 10 for civil engineering. Can you believe that? Less than 10 in the whole state in government-run common admissions? The English language issue is also stark: far from producing world-class scientists and engineers, we produce people who are functionally barely literate in both English and STEM.

The less said about humanities education the better: these students are in the forefront of aping Western fads like wokeism, nothing more. So there are some serious problems, and recent education ministers have not been exactly confidence-inducing.

Stock Markets

Indian stock markets have had a good run, and naturally a correction should be coming. The economic fundamentals are strong, but by some historical measures such as Price Earnings Ratio, the current valuation of the market is too high. It is true that India has some 84 unicorns (startups valued at over $1 billion at the beginning of 2022, more so than any other country except the US and China). The entrepreneurial ferment is excellent, but one can question whether or not they will justify their valuations.

Some of the companies that went public also don’t seem to have a ‘moat’ protecting their business that would justify lofty valuations, eg payTM. Its founder reportedly rued the fact that he went public at this time. There is a bit of a bubble, as in the 1999 Internet Bubble in the US, and when the day of reckoning comes, it will be a little painful for a lot of us.

Nevertheless, the medium-term story is pretty good, and is based on good demographics and the observed fact that at a certain GDP per head, things take off in the economy. We are at that level, which I believe is in the range of $2000-$4000 GDP per head. With digitization, a lot of hanky-panky has become either more difficult or impossible to pull off, and the formal economy has grown and with GST, tax collections have grown as well. This is a positive feedback loop which will enable greater investment in both physical and virtual platforms, thus freeing entrepreneurs and industrialists to streamline their operations.

A simple example is how GST has removed border checkposts, thus reducing waiting time and bribes for interstate transport. This sort of easing of friction and thus improving efficiency is a long-term asset for India, and that optimism may be reflected in the market.

Thus, as always when it comes to India, there is room for both optimism and pessimism. But even the pessimists must concede that there is some positive momentum, and that India may finally be shedding the vestiges of the self-defeating policies of eras past.

1730 words, Jan 13, 2022

Share this post