This long-read essay was published by swarajyamag.com at Is Industrial Policy The Right Answer For India? as their March cover story.

Should India have an Industrial Policy? Reasonable people can honestly differ on this question. There are several sub-questions: Does India have the State (and labor force) capacity to come up with, and deliver on, such a policy? What has been the experience in other countries, and indeed in India, when there was implicit or explicit policy in place?

Perhaps more fundamentally, is manufacturing important, or should India jump straight into services? Does India need an explicit Industrial Policy that identifies strategic industries and picks winners and losers, or is it enough to put in place regulatory, antitrust and related mechanisms to provide gentle guidance? What about incentivizing R&D and radical innovation? How can taxation be made a tool of Industrial Policy if not also used for social justice?

In the wake of the recently introduced Production Linked Incentives in various sectors, and the immense efforts being made to jump-start the semiconductor ecosystem, these questions take on some urgency. There are a number of factors, including the putative ‘demographic dividend’, and the fact that India is in the $2000+ GDP per capita range, which is often a takeoff stage.

Industrial Policy now has another driving force: national security, from at least two perspectives. The first is that India was for quite some time the world’s biggest buyer of defense equipment. It is a huge risk because of potential embargos. Second, it is clear that depending on others for crucial components can be potentially disastrous: remember US technology denials in supercomputing, and cryogenic engines, as well as China’s sudden decision to deny Japan rare earths supplies.

But there are some downsides too. India’s earlier flirtation with State-guided growth, as in the Five Year Plans, ended up in the debacles of the License-Permit Raj, large-scale nationalization, and a ‘hybrid economy’ which was the worst of both worlds, capitalist and socialist. More recently, the ‘Make in India’ lion mascot has been quietly shelved, and despite Atmanirbhar Bharat, our trade deficit with China continues to soar.

The ghosts of the mai-baap sarkar and the ample mammaries of the welfare state continue to loom over India. Just a week ago, aspiring railway employees set fire to trains out of general frustration: it is reported that 1,25,00,000 people applied for 35,281 positions. The attractions are obvious: government jobs mean no accountability, no performance reviews, no chance of dismissal, plus baksheesh and pensions. This breeds mediocrity, as in the Soviet Union.

Is Manufacturing Important?

In a word, yes. Indians dazzled by the success of the IT services industry may not agree, and to give credit where it is due, it has provided decent jobs and created wealth (in many cases, extraordinary wealth) for a lot of individuals, but it is still a drop in the bucket. According to Association for Computing Machinery cacm.acm.org there is a total of 4 million direct and 12 million indirect jobs in IT, but that doesn’t begin to address the problem of providing jobs to the perhaps 10 million young people entering the workforce every year, often with a poor education that has taught them no skills.

Besides, manufacturing cannot be seen merely as a provider of jobs for the teeming masses: its effects persist. It may have a critical role in the creation of dynamic competencies that enable a nation to be resilient to changes in the industrial and trade environment. It is well-known that entire industries do have a lifecycle S-curve, wherein they rise, plateau, and despite possible mid-life kickers, they eventually decline. The physical and financial infrastructure, the supply chain linkages, and cluster effects, however, have lasting value: see how, for instance, Silicon Valley has weathered several waves of disruption and may yet recover from the latest.

In 2004, Dani Rodrik at Harvard wrote an influential paper titled Industrial Policy for the 21st Century. But these ideas are not new. In a seminal paper from 1986 in Research Policy titled Profiting from Technological Innovation: Implications for Integration, Collaboration, Licensing, and Public Policy, the Berkeley economist David Teece provided a grim warning against deprecating manufacturing:

… Put differently, the notion that the United States can adopt a “designer role” in international commerce, while letting independent firms in other countries such as Japan, Korea, Taiwan or Mexico do the manufacturing, is unlikely to be viable as a long-run strategy.

Teece was prophetic, as China has demonstrated by de-industrializing the US. This explains America’s huge and growing trade deficit with China, and the US is hanging on largely because of the fact that the US dollar is the world’s reserve currency. If and when that changes, the US economy will be in trouble.

India, in semiconductors for example, is justifiably proud of its design talent, but that is a moveable feast as the designers can move anywhere, to any geography. They are footloose, and in any case, design is only a part of the value chain (albeit a very important one). On the ground capital investments, which amount to up to $20 billion, are not so easy to transport.

Indians need look no further than the recent pandemic to see the truth of Teece’s emphasis on manufacturing. Without the existing capacity for scaling up vaccine production, India would have been left in the lurch. The 1.5 billion vaccination landmark is entirely the result of having implicit manufacturing know-how and supply chains. Even more impressively, Bharat Biotech’s success at inventing and bringing Covaxin to market is the very kind of R&D and innovation success story that manufacturing brings.

The Economic Survey 2022 also points to this factor: manufacturing has recovered faster than services post-pandemic. That is possibly because many services are optional: vacations, dining out, even haircuts can be postponed; yes, non-essential big-ticket purchases of manufactured goods like cars can also be postponed. But on average, manufactured goods, as well as agriculture (well, you have to eat even in a pandemic) appear more ‘sticky’ in terms of sustained demand. Remarkably, it is the public sector that has supported services demand, especially defense related spending and I imagine healthcare spending (all those vaccines).

Fads, fashions and duality in business models

The world of business is apparently as prone to fads as the fashion industry itself. We know how, in the latter, what we today think of as quaint curiosities as 1970s bell-bottoms will reappear eventually as the very height of a la mode fashion. Similarly, fads in trade and industry (or at the very least, tendencies) have a way of showing up again eventually.

There are probably good explanations for this recidivistic behavior. One possibility is that there are multiple reasonable and viable business models that vie for acceptance; once one of them becomes dominant, then we inevitably see the flaws and excesses in that model. There is a backlash, and the charms of the alternative model become ever-more seductive, and eventually there is a wholesale switch to that model. And then it is rinse, repeat.

It is also possible that the Universe is fundamentally a steady-state entity, one that doesn’t lend itself to linear models of ever-greater progress. It may be cyclical, as there may not be one right answer to the problem, so that we oscillate between two different models. That is pretty much what we are seeing in business and industry all the time: a model succeeds for a while, but then the pendulum slowly swings back to the alternative.

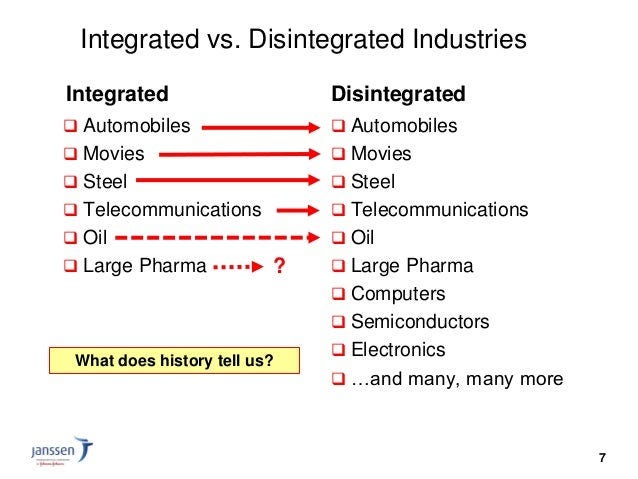

A good example I have observed is the tension between an integrated and a disintegrated model in the computing industry. In the early days of computing, the integrated IBM model was dominant, where IBM provided everything lock stock and barrel: hardware, software, peripherals, consulting.

It worked for a while, but in the second phase of computing, it was the disintegrated Wintel model that succeeded, with Intel and Microsoft providing the core technologies, but a veritable army of partners offering a plethora of solutions.

That seemed to be the obvious solution, and the ecosystem thrived, although many OEMs such as HP, Dell, Toshiba etc made only tiny profits, as the vast majority of the margins were sucked up by the Intellectual Property holders, mostly Intel and Microsoft.

It was into this world that Apple iPhones arrived with a fully integrated model (especially control of the user experience): chips designed by Apple, software made by Apple, hardware assembled by Apple, with the only open part being the third-party software catalog (though even here Apple charged/charges a hefty 30% fee). This has succeeded wildly, making Apple by far the most valuable company in history with a market capitalization of $3 trillion.

It is a fair bet that the next phase of computing will be another pendulum shift to disintegration as the Apple model runs out of steam. Let us note that even though it gushes cash, there have been no exciting new products from Apple for years.

end of Part 1

Part 2

Laissez-faire vs. Industrial Policy

It is in this context of pendulum shifts that the rise of Industrial Policies across the world should be seen. On the one hand, there is a backlash to the laissez-faire Reagan-Thatcher revolution of the 1980s that was itself a backlash to the interventionist days of the 1970s in the West, with inflation reaching double digits, and industrial stagnation. It was felt at that time that letting ‘animal spirits’ loose would be the right answer.

The collapse of the Soviet Union and its planned economy provided the same lesson: that centralised decision making leads to suboptimal outcomes. In India, the famous Five Year Plans and the Nehruvian State occupying the “commanding heights of the economy” had disastrous results. The famous BRICS paper (Dreaming with BRICS: the path to 2050) from Goldman Sachs said in 2003:

An analysis of what the dirigiste and sclerotic Indian State accomplished, based on the data in that paper, presents a stark picture. India had the ability to grow at 7.5 per cent annually in GDP, but it managed far less, 4.5 per cent, between 1960 and 2000. The dramatic difference this made is seen in GDP per capita for South Korea and India which were roughly at the same level in 1947, but now the Koreans are some 15 times more prosperous. They did grow at 7.8 per cent annually.

On the face of it, this suggests that leaving things to the private sector, as Korea largely did with its chaebol, would be the right answer. Yes, these giant conglomerates have helped Korea forge ahead, but there are plenty of concerns. For instance, the head of Samsung, the biggest of them, has just come out of jail on various charges.

Similarly, the unfettered run that Big Tech has had in the US has brought in its wake all sorts of problems, especially in terms of freedom of expression, as well as their opaque and outsize influence on mass psychology: the ‘surveillance economy’ as per Shoshana Zuboff of Harvard. Their cavalier use of individual data is particularly worrisome.

The problem then is of excess. Laissez-faire has its plus points, but it eventually leads to consolidation, firms that are too big to fail, lack of competition, lack of innovation, a shift in the power balance that ends up hurting consumers: all the things that are the basis of antitrust litigation. Antitrust has gone through its ups and downs in the West as well, although there doesn’t seem to be much of a concern about this other than on leftist social media.

There were, for instance, the Robber Barons of US industry in the early part of the twentieth century, who accumulated vast power; and then the 1929 crash (not entirely sure if excessively large businesses were the cause of the crash) brought that edifice down. This cycle is repeated throughout the history of business, for instance, the Dutch Tulip Bubble. The classic Extraordinary Popular Delusions and the Madness of Crowds is a useful analysis of mass psychology that usually means that bubbles usually end up in tears.

The 1999 Internet bubble was one such. It can be argued that today, the extraordinary valuation of Big Tech is another bubble just waiting to burst. The sudden collapse in Meta/Facebook’s shares by 26 per cent on 3 February is an indication that all is not well.

There’s another good reason for the backlash against big business. That has to do with the de-industrialisation of the US after the entry of China into the WTO in 1990. China started offering the ‘China price’, a cut-rate price for practically everything. How much of this was because of hidden subsidies is not clear, but the fact is that they succeeded in undercutting the prices offered by domestic manufacturers in other countries, who went out of business.

The result is the widespread single-source phenomenon in many industries. Managers seeking to squeeze the maximum profits decided to abandon other suppliers. This works well for a while, as economies of scale enable Chinese suppliers to cut prices to the bone. But in the long run it gives China a dangerous veto over critical parts of the supply chain, and is an example of David Teece’s warning about not losing control over manufacturing.

In the 1980s, there was a fear about an exodus of manufacturing to Japan, but the Plaza Accord and other machinations by investment bankers enabled the Americans to fend off the Japanese challenge, and to mire that country in a recession that it hasn’t yet fully recovered from. Unfortunately, American Big Finance now has so much invested in China that they are, in the words of the Wall Street Journal, “China’s best friend in the US”.

So both the managers of large companies and the finance types have, in a sense, conspired to make China powerful: and it has everything to do with their incentive structure, which is short-term profits. That is a point to be kept in mind when thinking about India’s policies too. The US can get away with being the world’s biggest debtor nation by dint of their singular ability to print dollars. India has to profit the old-fashioned way: by earning it.

A useful Western perspective on industrial policy can be found in The Economist magazine’s Special Report: Business and the State in their 15 January 2022 edition. However, much of it is not applicable to India, given that they are looking at protecting already large and often global companies, whereas India is looking at putting in place mechanisms to support the development of local firms in sectors of interest.

What does industrial policy mean in practice?

There are at least four things that the (Indian) state can do to actively promote an industrial policy, in addition to, of course, propaganda and marketing. These could fall under the headings of:

- Infrastructure

- Incentives

- Regulation

- Taxation

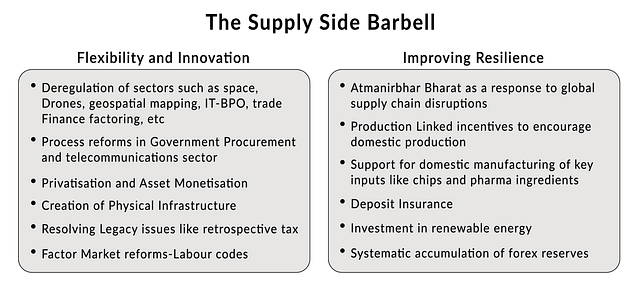

The handy Economic Survey 2022 provided the following graphic:

A fair bit of this has to do with Industrial Policy.

Infrastructure

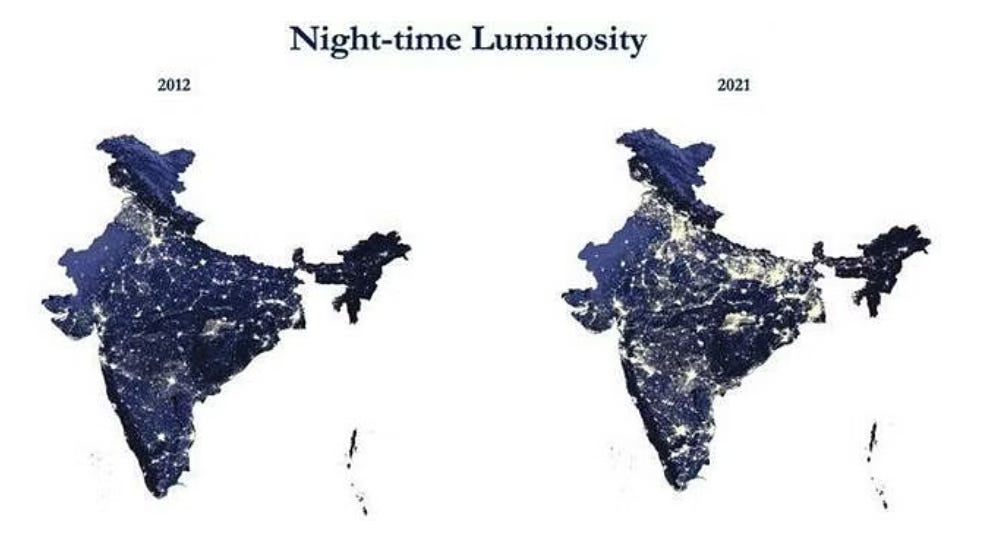

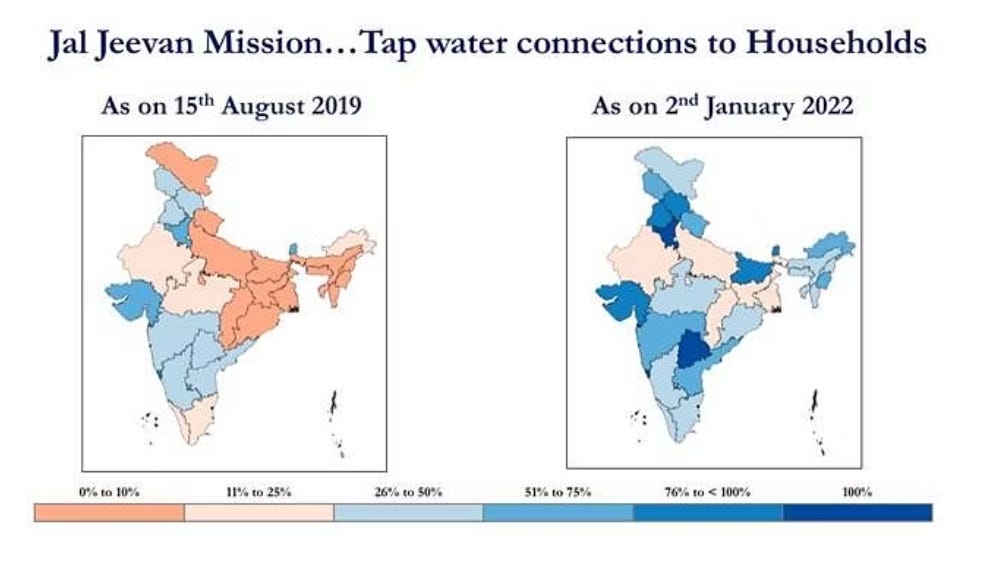

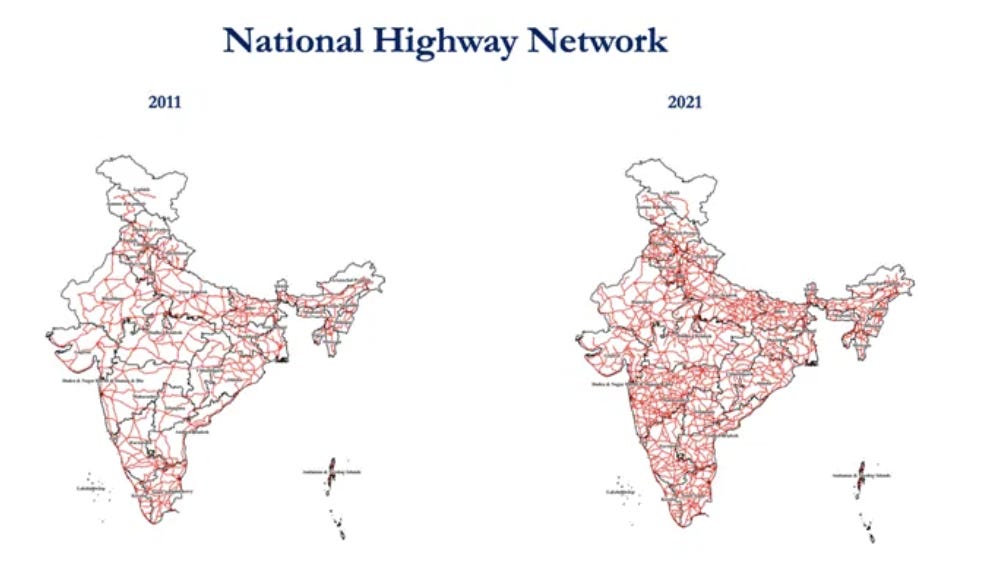

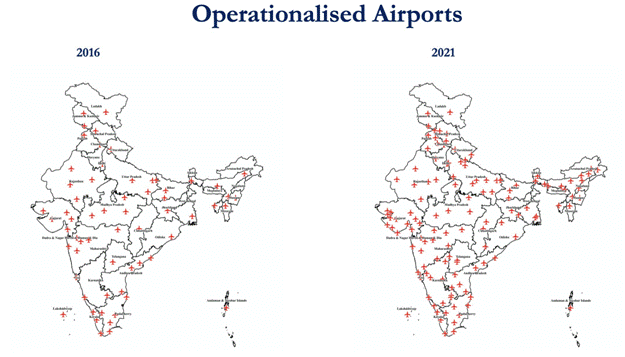

The Government of India is engaged in a strong push for infrastructure, both hard and soft, that is, both physical and systemic. What is most visible is the physical infrastructure part of it, and there were several graphics in the Economic Survey 2022 that showed these off from the point of view of a consumer, but it makes sense from the point of view of business as well. Physical infrastructure enables logistics for all, and is a permanent asset

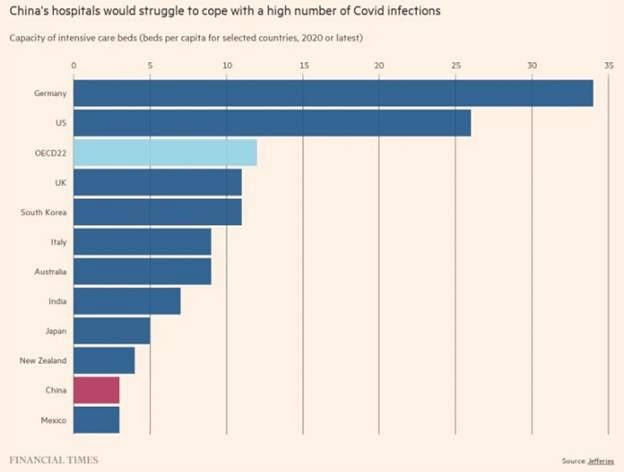

The idea that India may have better emergency medical infrastructure than China, the much-admired New Zealand, and even Japan, is a bit startling. Besides, the extraordinary vaccine ramp-up with 1.5 billion shots, almost all of it local invented and/or manufactured, suggests that at least in that domain, India has reached critical mass.

(PC: Financial Times)

Systemic and soft infrastructure may be more of an issue: the rule of law, proper land records, quick resolution of disputes, consistent (and not whimsical like ‘retrospective tax’ by the UPA) rules and regulations, sensible Reserve Bank policies, and most of all, limiting loopholes and corruption.

Knack and Keefer of the World Bank suggested in 1995 five factors that lead to increased economic growth:

1. Quality of bureaucracy

2. Corruption in government

3. Rule of law

4. Expropriation risk

5. Repudiation of contracts by government

India’s much-maligned (often deservedly so) bureaucracy does have the capability. It’s just that it is seldom used. It can deliver at scale. The Kumbha Mela, which is an enormous challenge, is managed perfectly by them, and so has been the Covid vaccination drive. Increasing formalisation means that petty corruption is beginning to diminish.

There is not much risk of nationalisation today (unlike in the bad old days of Indira Gandhi). In fact, a Congress MP complained in Parliament that the Modi Administration had not created a single PSU! That is high praise, considering that some PSUs (I seem to remember SAIL) have consumed their entire capital through accumulated losses. The privatisation of noted white elephant Air India is a positive sign; so is the upcoming IPO of Life Insurance Corporation.

The UPA habit of imposing retroactive taxes is an example of the Indian government not honouring its contracts. The unedifying spectacle of the Antrix-Devas contract is another blot on India’s image as being a good place to do business. Fortunately, current efforts to settle with Vodafone and Cairn Energy will put an end to a shameful episode.

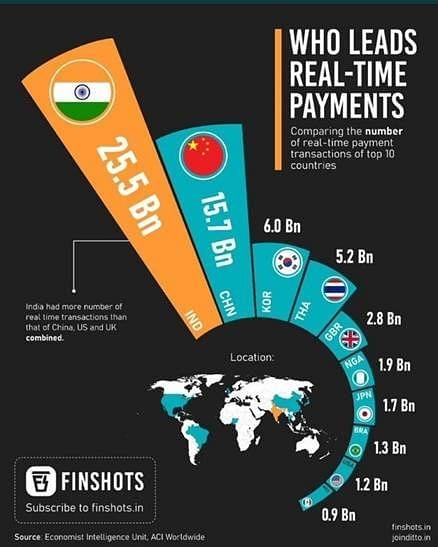

India is beginning to shine in the financial aspects of soft infrastructure with the transparent UPI and India Stack, as well as the unfairly-maligned Demonetisation and GST. All this reduces the chances of corruption, and the role of intermediaries, which of course is the reason the so-called Chandigarh lobby of arms brokers is upset with the indigenisation of weapons purchases.

(PC: Finshots)

Unfortunately, the judicial part of soft infrastructure is in shambles. Cases that go on for decades, rampant influence-peddling by high-powered lawyers who are also senior politicians, and the enthusiasm of judges to over-reach beyond their remit (for example, on favourite woke causes) are all causes for alarm, and need to be fixed.

The other area where technology may offer a quick fix is in property rights, specifically land records. Today the system is unreliable and prone to manipulation, which in particular hurts the entrepreneurial lower economic strata, which are unable to leverage their land ownerships into business loans, and are instead pushed into the arms of usurious loan-sharks. Development economist Hernando de Soto suggests that secure property rights are a key factor in growth.

At the very least, digitising land records (‘One nation, one record’) and then putting them up on blockchains so that smart contracts can be executed on them would be a major improvement.

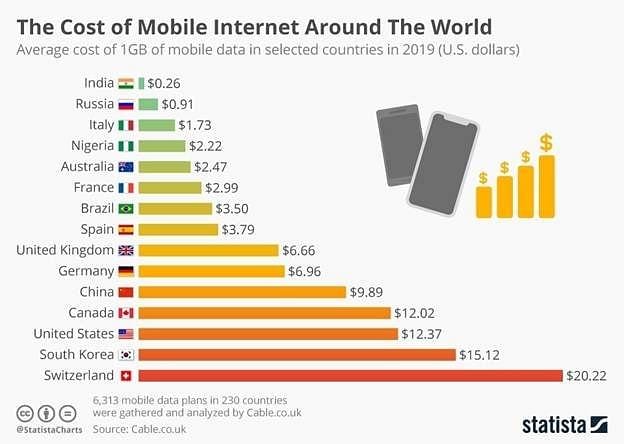

Digitisation, in general, is a process India needs to carry forward. The JAM trinity, Direct Benefits Transfer, and so on cut down dramatically on leakage and improve formalisation of the economy. One of the best infrastructural things India has done is to make Internet data access absurdly cheap and thus accessible to even the less well-off. And they have responded in kind, consuming data, especially mobile data, by the boatloads.

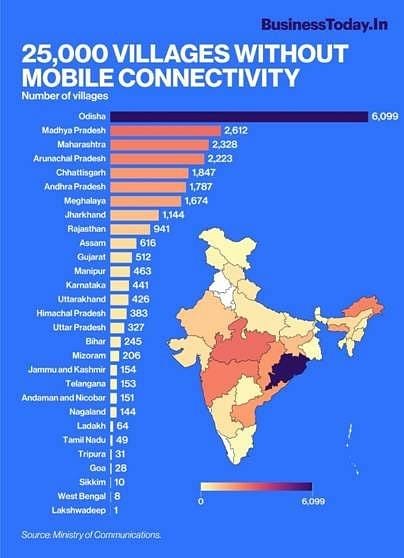

However, the mobile infra is not yet complete, and there are remote areas yet to get coverage. It is to be hoped that gradually they too will come on line.

(PC: BusinessToday.in)

Incentives

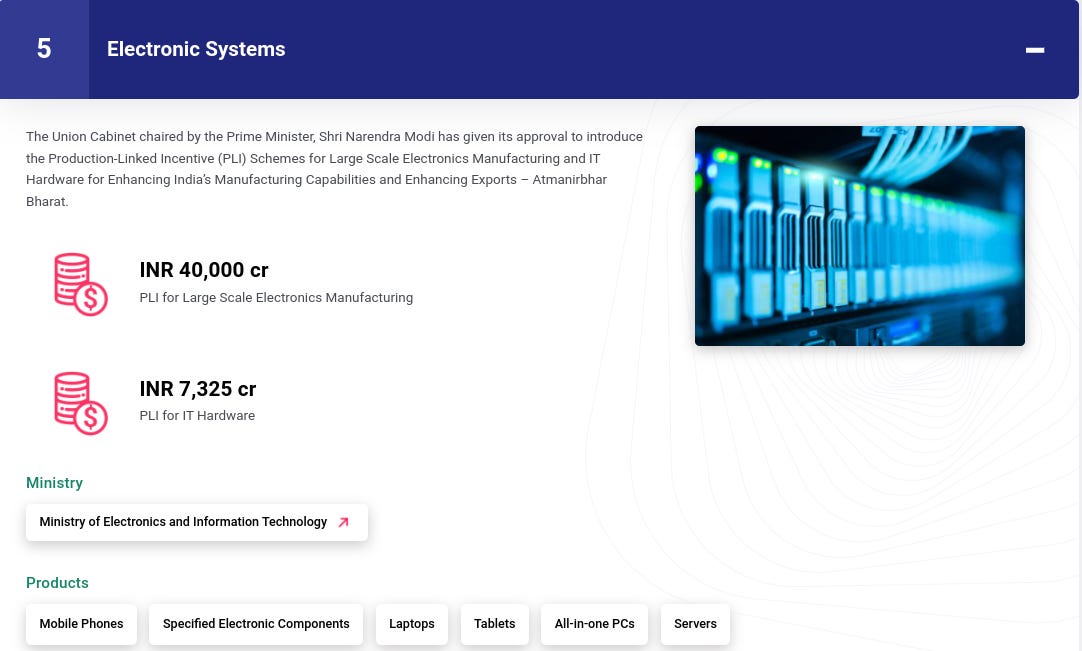

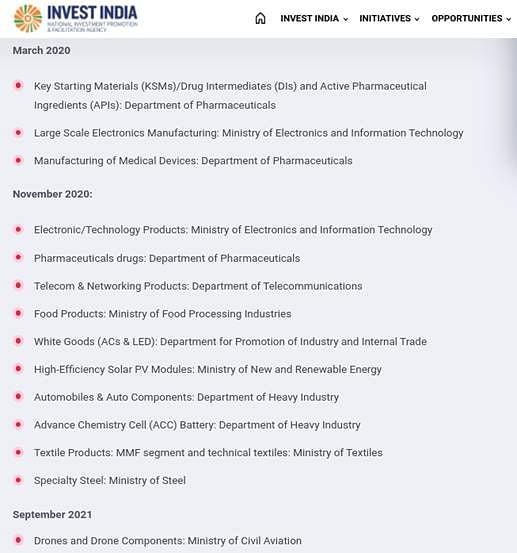

There has been a slew of Production Linked Incentives offered by the Government of India to manufacturers in 13 industrial sectors, all of which may be viewed here.

The fact is that giving a positive nudge in specific sectors works; this can be seen in the way mobile manufacturing by Samsung and Apple partners will create $5 billion worth of exports each this year. Others like HP are beginning to build computing products as well.

The fact that a rapidly growing India will also be a huge market can be leveraged. So it’s a carrot and a stick: engage with us or be excluded from a billion-person market (incidentally, that siren song worked wonderfully for China, and needs to be marketed heavily by India too).

In the past, incentives given to IT services companies, especially in terms of subsidised land, have worked well to produce export revenue. To a lesser extent, Special Economic Zones have also worked, though not as well as they were expected to. The broadening of SEZs in the latest Budget is a recognition that they need to be fine-tuned.

Perhaps the most significant incentive offered is that in semiconductor fabs, where the government has promised as much as $10 billion in support. Semiconductors are that critical to the future of industry. The late Professor C K Prahalad wrote in his highly acclaimed paper The Core Competence of the Corporation that it is only those companies that anticipate and invest in the core technologies of the future that will succeed; indeed, the same is true for countries.

In addition to these incentives to industry, there needs to be a more pervasive shift in the support for innovation. It is a sad fact that Indian firms invest almost nothing in R&D; perhaps tax incentives would be helpful, as we shall see in a later section. There is also no incentive for academics to work with industry, as I wrote in a report for the Kerala government a few years ago. Unlike the professors at Stanford, say, who are constantly spinning off startup firms, there is almost no such activity in India. That is a huge opportunity lost.

Professors should be incentivised by the number of industry projects they bring in; their key result areas should include consulting revenue. A recent report from the CAG complained that even among the IITs, the new ones were not generating enough industry revenue and needed continuous infusions of government money to stay afloat.

The other area is support for Intellectual Property development. I was a member of the panel that wrote India’s first IP Policy in 2016, with the explicit goal of increasing patents, designs, copyrightable material and other IPs in India, and making the process less complex and less expensive for aspiring creators or inventors. I am sorry to say that the Policy has not made the impact we hoped it would: most of the IPR produced in India is still owned by MNCs.

Regulations

It is quite possible that the best thing the government can do is to set up a good regulatory framework, and then get out of the way, instead of micro-managing as in the Mahalanobis world-view. In general, this has worked in the telecom domain, and of course, there are winners and losers. It is not the role of the government to bail out those companies that do poorly.

That should be the mechanism in general: not too much intrusion by the bureaucracy. But good regulations are also necessary. For instance, mobile money was first introduced on a large scale by Vodafone’s subsidiary in Kenya, which brought out m-Pesa, which is quite successful. When they applied to do business in India, however, the regulator did not accept their proposal because m-Pesa was in an antagonistic position vis-a-vis banks.

The Indian regulator held that mobile money systems had to be created in conjunction with banks. Even though it might have appeared a little odd at the time, it turns out to have been a good idea: for, in India, the growth of mobile money has roped in the banks, whose accounts are used (instead of wallets). Thus they too have a stake in the growth of digital money, apart from the fact that they are finding cost reductions from reduced ATM activity.

Even though it is early days, Indian regulators should put in antitrust provisions as well. One of the justifications for antitrust action in the West has been the concern that consolidation leads to less consumer choice, and kills off innovation.

India’s problem has been sort of the opposite: how to nurture multiple competing private sector firms as the public sector retreats, as in airlines or telecom. And it has not been all that successful, as there is a tendency towards oligarchies and managed prices. We have all seen how mobile data prices have increased some 20 per cent in lockstep recently.

Taxation

The final arrow in the government’s quiver is tax policies. There must be tax incentives to chosen sectors, as well as to encourage R&D in general. This is becoming critical as there are several new technologies that could be game-changers where India is essentially absent except as a laggard.

These technologies include areas such as Artificial Intelligence/Machine Learning, blockchains and cryptocurrencies (the Budget finally providing some clarity on taxing these and on a possible RBI central bank digital currency is helpful), quantum computing, drones and other autonomous vehicles, fuel-cells, hydrogen-based and other ‘green’ energy, fast-breeder nuclear technology, advanced aircraft engines, and genetic engineering/gene editing such as CRISPR-Cas9.

Some of these technologies could become the basis of giant firms in the next few years, but unfortunately, there is virtually no R&D done by domestic firms in these areas. There should be tax breaks for speculative research and for innovative companies. There are investment tax credits in the US that seem to be an attempt at encouraging R&D in specific sectors by the private sector, by subsidising some of their investments.

A similar mechanism should be considered for Indian firms as well. There is a requirement that corporations must spend some percentage of their profits on Corporate Social Responsibility-related activities. This is an ill-considered additional tax, and it should be repealed and substituted by tax credits that support leading-edge R&D. If so, perhaps over time, the abysmal spending by Indian firms on research – much lower than global levels – will go up.

In particular, the investment tax credits can also be approved for industry-academia collaboration, which would encourage industry to engage with professors, which would be a win-win. The UK recently proposed similar tax breaks for R&D if it is conducted in the UK.

The US has a new $250 billion Innovation and Competition Act, which routes funds for AI, robotics, biotechnology, space exploration and for setting up new hubs outside Silicon Valley. France has its own ‘France 2030’ vision. It is not clear how much of this is based on tax provisions, but we can also look at the early success of Japan’s MITI a few decades ago, and learn from all their mistakes and their successes. Promising startup firms can be supported with tax holidays as well.

There is a revival of Industrial Policy around the globe, especially in view of supply chain disruptions and national-security considerations. This is a most opportune time for India to jump-start its R&D and innovation activities with a focused set of objectives and deliverables.

If we do this correctly, the nation should be able to develop a few world-class companies in the next few years, and simultaneously support national objectives. Pure laissez-faire has been a bit of a failure because it pursues efficiency at the cost of resilience.

Feb 2022

Ep. 58: Is Industrial Policy the right answer for India?