Note: a version of this essay has been published by rediff.com at https://www.rediff.com/business/column/rajeev-srinivasan-indias-quest-for-a-role-in-the-future-of-semiconductors/20211228.htm

The announcement of a new semiconductor policy on December 15th is welcome news, and the concerned ministers need to be complimented on putting it out there. There is a caveat though: it is too little, too late; this should have been done 25 years ago. And the amounts being committed by India ($10 billion) pale in comparison to what other countries are rumored to have earmarked: $50 billion by the US, $100 billion by South Korea, and $450 billion by China, according to the Indian Express.

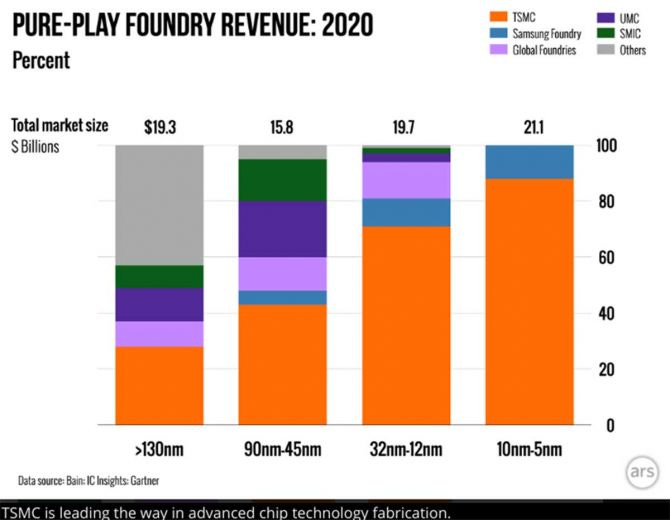

This is a big boys’ game. IC Insights says chipmakers will spend $152 billion this year on new fabs and production equipment this year, up from $113 billion last year. They expect investment to continue to rise at that clip of over 30% a year.

The reason is simple. If abundant oil and gas drove the 20th century economy, it is data that will drive the 21st century. To be precise, it is the ability to collect and manipulate data. And at a very practical level, it means the ability to create the semiconductors, that is chips, that power up most of the data-manipulating devices such as phones, computers and IoT devices. So whoever owns the best chip industry will be the Saudi Arabia of the era of data.

There is one statistic that remains with me from the time I was running an incubator for electronic hardware companies, funded by the Government of India: that India’s import bill for electronics would exceed India’s import bill for oil sometime in the next year or two. And this was even before the production-linked incentives made India a big maker of things like mobile phones.

As basically a software man I had always focused on the design side of things. My undergraduate degree in electronics is a distant memory. While trying to steer a bunch of startups, and establishing an assembly line for manufacturing for them (and others), I had to pay attention to this segment, and how important it is.

The bottom line is that it is pretty clear that it is a strategic imperative for India to have the ability to make its own chips. At the most elemental level, computer security of any kind can easily be subverted at the hardware level. In other words, if the lower layers in the stack are compromised, there isn’t a whole lot you can do at the system or encryption layers.

Therefore, at least for sensitive military applications, it is evident that India must control the entire process, and preferably the entire Intellectual Property, related to at least some part of the product spectrum. It has been customary to build military hardware with customized chips, often radiation-hardened and tamper-proofed, and also gold-plated-level expensive. However, it is also true that designers have lately started looking to use the far less expensive and fast-evolving commercial chips in their military-oriented products.

Beyond that, with its rapidly increasing consumption of commercial chips especially in the telecommunication market, India cannot afford supply chain disruptions. There is a global shortage of semiconductors as the result of the pandemic and related supply problems, and India cannot be at the back of the queue when manufacturers dole out chips in future crises.

There is a telling parallel with the vaccine-production saga. Can you imagine how India, with its demand for some 2 billion units of covid vaccine, would have fared in the world of the Pfizers and Modernas and Astra Zenecas if it didn’t have its own giant pharma industry, with the ability to rapidly scale up production and also to invent new vaccines like Covaxin? That’s right, nobody in India would have been vaccinated, much like most of Africa has not been.vaccinated.

There is also another precedent. A few years ago, China, the world’s largest supplier of rare earth metals, abruptly cut off supplies to Japan without warning. As a result, a good bit of Japan’s electronics production came to a grinding halt. The same thing can happen to India if it depends on foreigners with agendas of their own.

In fact, chips are one of several seminal technologies that will determine India’s position in the world in the next few years, and India is lagging in every one of them: AI, quantum computing, CRISPR-Cas9, maybe mRNA and maybe blockchains. A famous paper by the late C K Prahalad on ‘The Core Competence of the Corporation’ suggests that companies (and by extension nations) that focus on long-term capabilities will survive. Others will not.

Therefore, India has to pursue chip-making by using its competitive advantages: design smarts, and a vast emerging market. Let us not dismiss buyer power: if India will buy a lot of chips, then chipmakers will gladly set up shop here. But more interestingly, the fact that chip design is a major skill in India can be leveraged. There must be a few thousand chip designers in India, who are employed by the who’s who of the semiconductor industry.

But this is a little misleading, like saying India has a lot of software services providers, because these people may only see a small part of the product life cycle. They may be adept at using software to do ‘fabless design’, ie. make the blueprints for what needs to be fabricated in actual factories somewhere else. I am not knocking that model: Britain’s ARM has made a fortune by doing precisely that, and it is more than 90% likely that your phone has a ARM-designed chip.

ARM has also done significant R&D to stay ahead of the curve, and anyway there is a new generation of chips coming up with open-source RISC-V technology from the University of California, Berkeley. This may democratize chip design, so that anyone is able to add value on top of a basic platform, but that needs R&D too. This may well be where there are opportunities for Indian companies to create Intellectual Property in new products.

So Indian firms, including the small entrepreneurial ventures that are coming up, will need to focus on products a few years down the road, because the current generation is already spoken for by the TSMCs, Samsungs and Intels of the world. And without some design-for-manufacturing nous, your designs may not be viable. I am wondering about what happened to IIT Madras’s RISC-V based Shakti chips: not sure they are being made in volume.

An entire ecosystem needs to be put in place, which needs everything from steady power to surprisingly large amounts of clean water, as well as guarantees about logistics and about disruptions such as through labor issues. Given India’s history of politically-launched strikes (see Sterilite and Koodankulam), possible industrial sabotage (see mysterious fires in Chandigarh’s Semiconductor Labs and at Serum Institute’s factory) there have to be strict security measures.

The ecosystem also consists of suppliers of specialty chemicals and gasses, and the large equipment manufacturers such as Advanced Micro Devices, LAM Research etc, as well as specialist photolithographers such as Canon and Nikon. There is a large set of these companies, and if you can get their attention, then you have reached viability.

This is exactly what Samsung did when it first got into chip manufacturing: they decided to built the largest chip factory in the world, which immediately got the attention of all the ecosystem players, who are keenly aware that their business is cyclical. Samsung quickly became a preferred buyer, and out of nowhere it has now become the second largest maker of all chips, including their powerhouse display division as well as their CPU division.

There is a precedent in India for this, too: private sector players that think big, have the risk-taking nous and the marketing savvy to make a difference. If the government sets the rules and demonstrates intent, creates a powerful regulator, and gets out of the way, things can happen. Any incentives are a sweetener. There are examples in cellular telephony as well as in software services. Given the right environment, India has managers who can excel.

Thus, even though it is belated, the semiconductor policy is something that can be a game changer for India. Hopefully, it will be.

1350 words, 22 Dec 2021

Share this post